Traditional players have historically dominated the European automotive market; however, the growing penetration of Electric Vehicles (EVs), albeit at declining growth rates, has created space for new entrants. The transition from internal combustion engine vehicles to EVs has somewhat leveled the playing field from a technological standpoint. Moreover, Chinese EVs are receiving government subsidies, have supply chain advantages – notably in battery production – and have been exposed to longstanding fierce domestic EV competition. In combination, these factors constitute a competitive edge against the incumbent OEMs in Europe.

Reputation as a determinant of consumer choice

However, what ultimately drives the purchasing of cars is how consumers feel and think. And thoughts and feelings are subjectively triggered by individual consumers’ interpretations of brand experiences from past to present. These feelings and thoughts can be quantified in a “reputation score.” The drivers for reputation are consumers’ perception of Product & Services, Performance, Leadership, Citizenship, Conduct, Workplace, and Innovation.

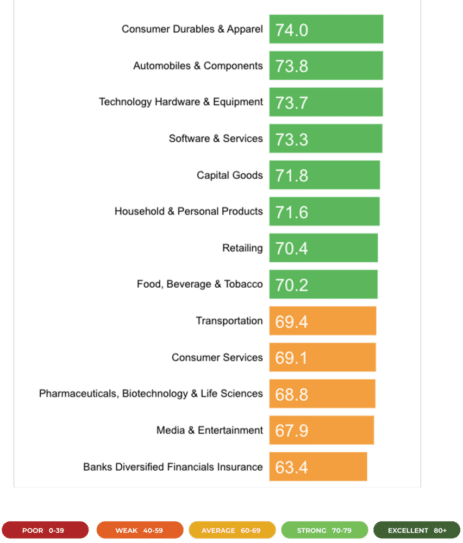

In other words, when OEMs battle to attract and maintain buyers, the relative reputation is the primary buying influence. According to The RepTrak Company, the automotive industry has the second-highest reputation in Europe. This means that breaking into the industry by a new OEM is relatively challenging compared to entries into other industries.

Lacking awareness of Chinese EVs brands

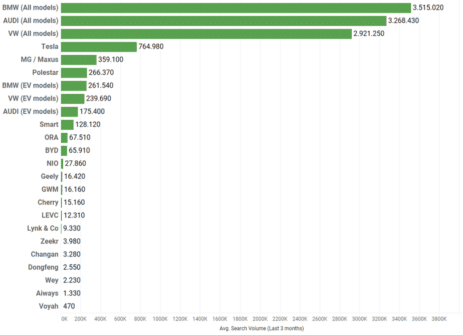

Obviously, to establish a strong reputation for a new entrant, consumers need to know the brand first. In marketing lingo, awareness is a necessary (but not sufficient) ingredient in a car launch. Awareness of Chinese EV brands in Europe is lacking if the volume of Google searches is applied as a proxy for awareness.

Additionally, a 2022 survey study by YouGov showed that only 14% of German consumers were aware of BYD, the world’s second-largest EV maker after Tesla. Only 17% knew Nio, 10% knew Geely’s Lynk & Co, and 8% knew XPeng.

The nascent proclivity to consider buying Chinese EVs in Europe

Despite a lack of awareness of specific Chinese OEM brands among European consumers, studies suggest a growing willingness to consider Chinese EVs, e.g., 29% in the UK and 43% in Spain. Notably, key barriers in the UK included ‘Political matters’ (37%), ‘Build Quality’ (36%), and ‘Lack of familiarity with brands’ (28%). On the positive side, key drivers were ‘Better value for money’ (30%) and ‘Better technology’ (10%). Thus, the challenge facing Chinese EV companies is two-fold—lack of company awareness and a negative perception towards their home market in China.

A strong reputation is a crucial entry barrier

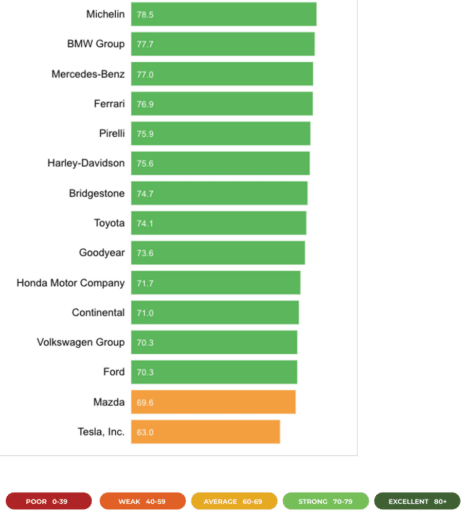

To enter a new market, any brand initially faces the significant behavioral challenge of ensuring first purchase. Barriers facing Chinese EVs are made even higher due to the strong reputation of existing competitors. Across Europe, renowned local companies like BMW Group and Mercedes-Benz and Asian companies like Toyota and Honda Motor Company have strong reputations with European consumers. Accordingly, the entry barriers are more than just price and value. It’s about trust and the willingness to try the products. Still, it remains to be seen if there is a segment of consumers seeking in the low to mid-price range that will not be so swayed by traditional brand attributes and attitudes around brands, provided safety is certifiably high.

Critical success factors for Chinese EVs launching in Europe

Launching a car in Europe is a multi-faceted endeavor. Homing in on the marketing and communication challenges and requirements, these are the critical success factors:

- Define a differentiated brand strategy: what is the brand’s narrative and position in the competitive European market?

- Understand the reputation barriers and develop specific reputation-driving initiatives strategically across the 7 reputation drivers to optimize ROI.

- Country-specific strategy: Europe is not one market. Each country is a distinct market in terms of tax, competitive situation, consumer preferences, etc. Thus, an insight-driven strategy must be carried out to define a successful launch roadmap across European markets.

- Establish a fully charged team for PR and crisis management to enhance brand trust, mitigate risks, and, importantly, address externalities to the perception of Chinese brands.

- Create the technical foundation for a seamless hybrid experience across multiple channels to accelerate time-to-market and ensure scale.

- Refrain from focusing only on sales conversion and integrate the post-purchase steps into the digital customer journey to earn Share of Life®.

For more info on the automotive industry, contact the Globant Automotive Studio. For reputation and launch strategies, contact Globant GUT.