Despite ongoing waves of digitalization that have aided in the transformation of financial services, trillions of dollars in real-world assets are recorded in many ledgers that remain independent from communication networks. Financial intermediaries record transactions on separate ledgers and then communicate with one another to reconcile their books and accomplish settlement. Coordination across ledgers and networks between companies produces inefficiencies that raise costs and risks, lengthen settlement times, and add overhead to financial services.

Recently, there has been a greater emphasis on technology like blockchain as a potential solution for overcoming these inefficiencies. The claimed benefit of blockchain stems from the combination of ledgers and networks so that numerous parties can see the same information, drastically decreasing the requirement for reconciliation after a trade or transaction. In addition to establishing a unified perspective of information (transaction balances, ownerships, etc.), blockchains or distributed ledgers also allow business rules and logic to be executed and examined in a deterministic and transparent manner.

Blockchain allows us to digitally, and peer-to-peer manage our property rights online. Tokens, or digital bearer assets, let us own and transfer valuable digital products from platform to platform online.

On October 31, 2008, a computer programmer using the pseudonym Satoshi Nakamoto posted an email to a cryptography discussion list announcing the creation of a “new electronic cash system that’s peer-to-peer, with no trusted third party.” This marked the beginning of bitcoin, the first decentralized cryptocurrency.

Satoshi Nakamoto’s purpose for creating bitcoin was to establish a “purely peer-to-peer form of electronic cash” that would not require trust in third parties for transactions and whose supply could not be changed by anyone else. In other words, bitcoin would bring to the digital realm the desirable characteristics of physical cash; lack of intermediaries and the finality of transactions. Additionally, bitcoin came with an ironclad monetary policy that cannot be manipulated to produce unexpected inflation to benefit an outside party at the expense of holders.

Bitcoin allows you to own and monitor wealth while still taking it anywhere in the world. It accomplishes this by allowing a large number of people who do not trust one another to agree on a ledger of accounts without using a third party. Anyone can use bitcoin, and no one can modify its rules. The blockchain contains the laws of bitcoin, such as its scarcity and transparency. It is not like traditional finance, in which governments may issue money and firms can close markets.

Bitcoin has subsequently fuelled the emergence and rise of several other cryptocurrencies.

As the “cryptocurrency” asset class grows, so does its lexicon, making it more challenging to stay up. The rise of cryptocurrency lending, such as DeFi and CeFi, has recently been a popular topic. What do these terms mean, and how do they differ from traditional finance or TradFi? In this study, we will deconstruct these terms and focus on how this wave of “Open Finance” is ushering in a new era of financial innovations, paving the way for the future of decentralized finance.

Why is a global open alternative to existing financial services needed?

Financial inclusion is crucial and is the bedrock of the economy. People with financial accounts can benefit from various financial services, such as saving, making payments, and accessing credit.

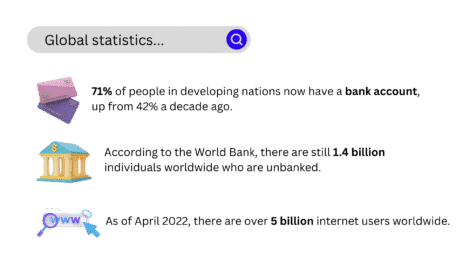

According to the World Bank’s Global Findex 2021 database study, 71% of people in developing nations now have an account, up from 42% a decade ago. The usage of digital payments had grown the most amid COVID-19 mobility limitations and when people viewed cash as unsanitary. Digital payments are often safer and more convenient and can serve as a gateway to other financial services. The proliferation of low-cost smartphones and internet access has accelerated the growth of digital payments.

Transformative innovations begin by solving a particular problem in an industry. For example, cryptocurrencies are positioned to aid in resolving issues connected to unbanked people. According to the World Bank, there are still 1.4 billion individuals worldwide who are unbanked, with the vast bulk of this population located in developing countries. In comparison, there are over 5 billion internet users worldwide (as of April 2022).

Bitcoin technology enables individuals to exchange currency without needing a third trusted entity, such as a bank, to oversee the transaction. In Latin America, as of 2015, 60% of the 600 million people did not have access to bank accounts. All that is required to use bitcoin for such a large unbanked population is a cell phone, which 70% of Latin Americans own.

Institutions are taking notice, as evidenced by a recent cryptocurrency report from Bank of America, which claims decentralized finance (DeFi) could be more disruptive than bitcoin.

Understanding Decentralized Finance (DeFi)

DeFi is an ecosystem of financial applications created on public blockchains, the most popular of which is Ethereum (ETH). It is a process that is supposed to lessen entrance barriers and give new potential for profit to investors.

It refers to decentralized applications (DApps) that deliver financial services using sophisticated and automated computer code on a blockchain as the settlement layer. Payments, lending, trading, investments, insurance, and asset management are among the services available, just as they would with a bank.

The code and processes that govern these applications are known as DeFi protocols. These protocols are often decentralized, use open-source code, and allow for flexible composability (code or applications can be taken from one protocol/service and plugged into another). These protocols have the potential to automate financial services such as lending and borrowing, trading, and asset management while decreasing the need for intermediaries to perform manual tasks. Such protocols have sprung up quickly, collecting billions of dollars in the crypto-asset business.

The principal goal of DeFi is to eliminate centralized financial authority and empower a more democratic financial system.

If there are centralized exchanges that facilitate cryptocurrency lending and trade, how is DeFi decentralized?

The primary premise behind a centralized exchange is that all cryptocurrency trading orders route through a central exchange (CEX), similar to traditional financial systems.

Exchanges like Binance, Coinbase, Kraken, and others are well-known in cryptocurrency. In this case, customers open accounts with these companies and utilize the same platform to transfer and receive payments. The exchange handles all centralized exchange transactions through an “order book,” which defines the price for a specific cryptocurrency based on current buy and sell orders — the same approach used by stock exchanges such as Nasdaq.

These exchanges mandate a complete KYC process; therefore, anonymity is not an option for customers. In addition to crypto trading, these exchanges support other services such as lending, borrowing, margin trading, etc. This category of cryptocurrency-related financial service is known as Centralized Finance (CeFi).

Since the centralized exchanges in CeFi are no different from traditional exchanges, one of the most significant contrasts between decentralized finance and centralized finance is that a central authority controls the mechanism in CeFi, whereas DeFi is not. The centralized exchanges are responsible for securing the users’ money in centralized finance. The idea underpinning DeFi, on the other hand, is that transactions will be successful as a result of smart contracts (an agreement between two parties that enforces certain rules/terms of negotiation when a specific/specific circumstance is satisfied). Simply put, users are accountable for managing their own funds and actions. Furthermore, DeFi is permissionless, meaning anyone from anywhere in the world can utilize its financial services without disclosing their identity.

There are trade exchanges in the DeFi world, but they are not the same as regular exchanges. A decentralized exchange (DEX) is a peer-to-peer marketplace where crypto traders conduct direct transactions. The most popular DEXs, such as Uniswap, PancakeSwap, and SushiSwap, price assets using a mathematical methodology that changes depending on the DEX. These DEXs are also known as automated market makers (AMM).

DEXs, unlike centralized exchanges, do not allow for fiat-to-crypto transfers; instead, they only trade cryptocurrency tokens for other cryptocurrency tokens. While centralized exchange transactions are recorded on the exchange’s database (which could be a private blockchain), DEX transactions are resolved immediately on the blockchain.

In contrast to CeFi, one distinguishing aspect of DeFi is that markets are always open, and no centralized authorities may restrict payments or refuse you access to anything. Though Bitcoin was the first DeFi program in many ways, the launch of Ethereum paved the road for leveraging DeFi’s potential within the financial industry. It created many options for establishing a transparent and robust financial system.

Who powers DeFi protocols if there are no “centralized entities”?

DAOs (Decentralized Autonomous Organizations) power DeFi protocols:

- DAOs are on-chain entities that help with decentralized protocol governance and economic coordination.

- A fee is frequently collected using the usual DeFi protocol and then directed to an on-chain treasury.

- DAOs enable DeFi protocols to put tokens in control of the treasury rather than the core founders.

- Token holders decide how to disburse funds, allocate budgets, and hire and fire contributors. DAOs are becoming in charge of larger and larger DeFi protocols and treasuries.

So how do you choose between DeFi and CeFi?

- CeFi is undoubtedly the superior option for individuals who appreciate customer service and feel irritated when they think of a firm controlled by an anonymous community.

- If you want user-friendly products that mimic traditional financial products’ security, appearance, and feel, you should remain with CeFi.

- DeFi may be more appealing if you rely on crypto for its reputation for anonymity and are afraid of governmental interference.

- If you believe centralized exchanges are vulnerable to fund loss, theft, or opaque trading operations, you are better off sticking with DeFi.

- Are you a tech-savvy crypto enthusiast that values security and ease of use but is prepared to accept less user-friendly features in exchange for greater flexibility? DeFi is the solution for you.

Although CeFi networks have a better level of industry adoption than DeFi networks, Blockchain analysts and technocrats have lately agreed that this might change rapidly. The value of the DeFi network has grown from virtually nothing to approximately $42 billion (as of January 2023).

Institutional DeFi

DeFi has undoubtedly piqued the interest of technology developers, investors, and financial institutions. As previously stated, large banks such as Bank of America are intrigued by DeFi.

While financial institutions recognize the potential of these technologies to streamline transactions in foreign exchange, equities, bonds, and other real-world assets, the challenges inherent in DeFi, such as the lack of identity solutions to enable institutions to meet anti-money laundering (AML), know your customer (KYC), and combating the financing of terrorism (CFT) requirements, have prevented adoption.

As a result, the concept of Institutional DeFi has emerged: a system that combines the strength and efficiency of DeFi protocols with a degree of safeguards to meet regulatory compliance and customer safety criteria.

Experimentation is essential for comprehending various ways to Institutional DeFi. Participants in the global finance business are increasingly undertaking pilots and experiments to investigate various design aims and options. DBS, Onyx by J.P. Morgan, and SBI Digital Asset Holdings collaborated on Project Guardian in Singapore. The Singapore Monetary Authority (MAS) announced this collaborative endeavor with the financial services industry to investigate the economic possibilities and value-added use cases of asset tokenization and DeFi.

As part of the first pilot, J.P. Morgan tokenized $100,000 in Singapore dollars as part of this test study. The $100,000 was converted to Japanese Yen in a subsequent currency transaction. The bank accomplished this via the Aave lending protocol and the DEX Uniswap on Polygon.

While Pilot One indicates the viability of Institutional DeFi solutions, additional effort is required to increase industry adoption and scale.

S&P Global Ratings’ recent announcement about the formation of the Decentralized Finance Group in response to rising investor demand is a positive indication for the industry. The company said: “S&P Global Ratings recognises that decentralised finance is increasingly transforming the capital markets, including an expansion in the spectrum of market participants, the creation of new asset classes, and the development of new capabilities in the execution of financial transactions.”

Closing thoughts

According to the World Bank, 9.2% of the world’s population, or 689 million people, live in extreme poverty on less than $1.90 a day, so it’s only natural for governments and the financial services industry to look for new ways to reach out to this large population.

Will DeFi be a viable solution for the financial industry to address this challenge? At this point, we don’t know if DeFi will transform the financial industry or if it can stay up with this innovation.

Influenced by the growth of cryptocurrencies and blockchain technology, many countries are developing CBDCs (Central Bank Digital Currency). A CBDC is a digital depiction of a country’s fiat currency and is not a cryptocurrency. Though designed similarly to cryptocurrencies, they may not require blockchain technology or consensus mechanisms for implementation. As of July 2022, 105 countries are exploring CBDC, which covers 95% of the global Gross Domestic Product (GDP). A few countries have launched a CBDC, and major economies, like China, India, and South Korea, are in the pilot stage and preparing for possible launches.

CBDCs eliminate the third-party risk of events such as bank collapses or runs because the central bank bears the risks that remain in the system. CBDCs, unlike cryptocurrencies, are naturally stable and do not experience dramatic price fluctuations. It also aims to minimize cross-border transaction costs and provide lower-cost solutions to people who now utilize alternative money transfer methods.

In any event, the future looks promising, and we at Globant will continue to keep an eye on innovations that have the potential to reshape the financial services industry.

Diving deep into DeFi…

The goal of this article, as the title suggests, was to decipher DeFi. To completely grasp the complexity of this financial innovation, however, we must go deeper into its underlying notions.

Our follow-up article, Exploring the depths of DeFi, will take you further down the DeFi rabbit hole.